The Milken Institute released its Best-Performing Cities 2024 report in February. This annual ranking looks at how well metropolitan areas are doing relative to others across several areas of economic vitality. The Milken report separates cities into two lists, large (200) and small (203), totaling 403 metropolitan areas. Within Arizona, Phoenix and Tucson are found on the large city list, while all others are on the small city list.

MORE NEWS: Here are the most trusted companies in Arizona and the U.S.

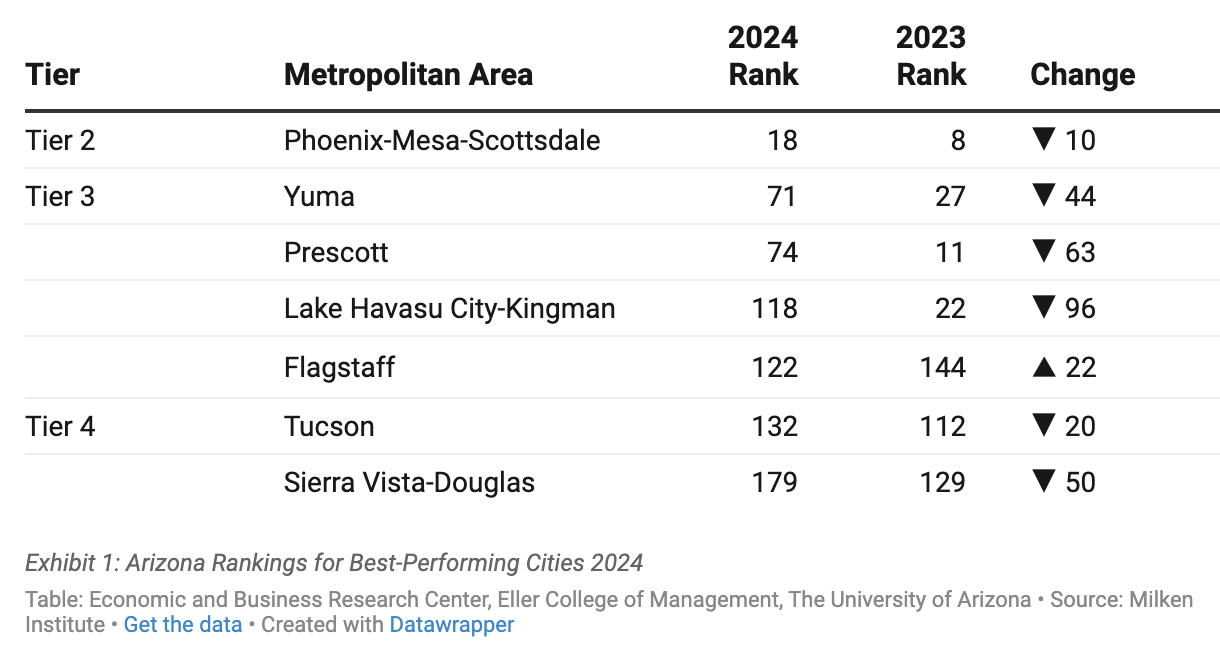

Arizona metropolitan areas did not fare well in the rankings for best-performing cities in 2024. Flagstaff improved its rank in 2024, moving 22 spots to 122 on the small city list. All other Arizona metropolitan areas experienced a decrease in rank for this year. Lake Havasu City-Kingman underwent the most precipitous drop, moving 96 places on the small city list from 22 in 2023 to 118 in 2024. This decline was among the largest on the small city list, with only two other areas (El Centro, CA, and Morgantown, WV) falling further.

The report further separates large and small city lists into five tiers. The size of each tier is based on the distribution of scores for each list. Phoenix and Prescott were considered Tier 1 cities in 2023. For 2024, Phoenix moved down to Tier 2, while Prescott slid even further to Tier 3. No Arizona cities landed in either Tier 1 or Tier 5 in 2024, as seen in Exhibit 1.

Exhibit 1: Arizona Rankings for Best-Performing Cities 2024

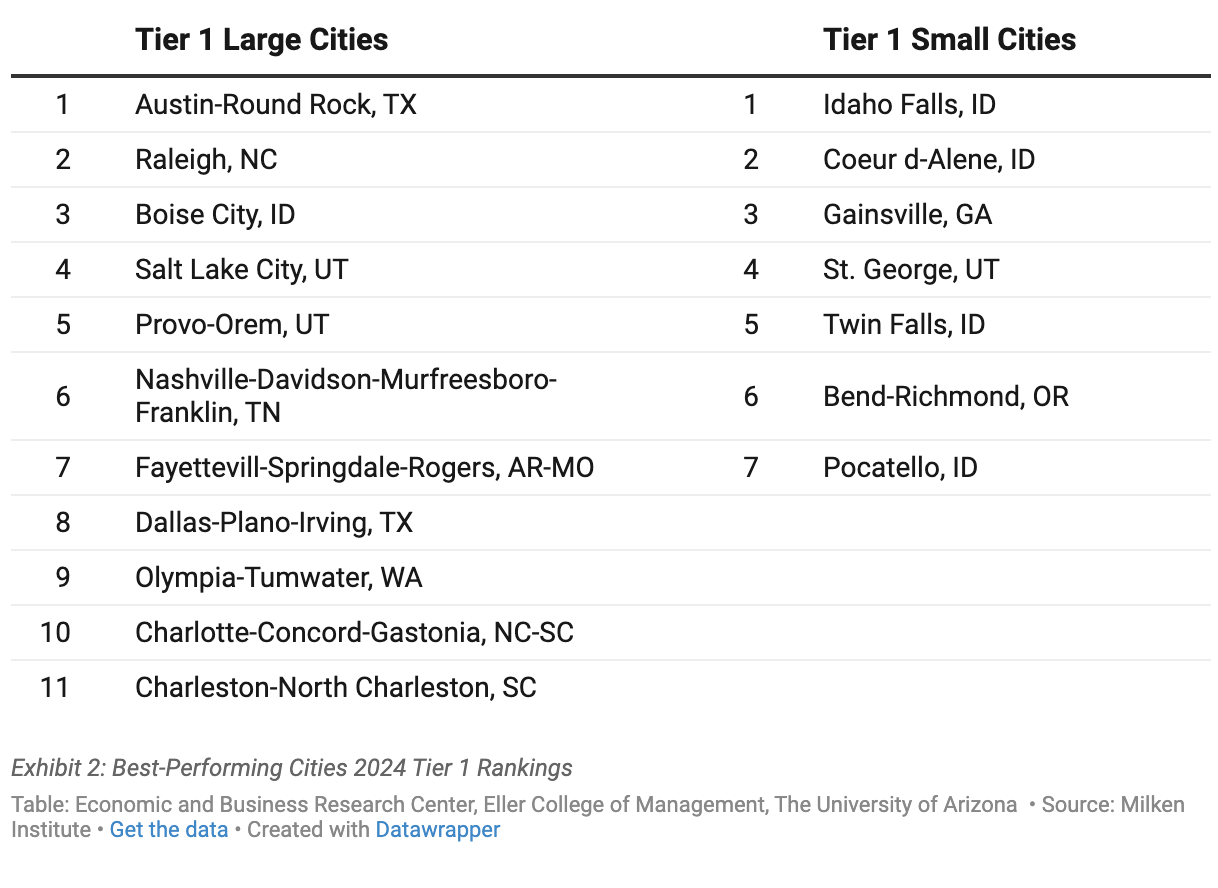

Austin, TX, moved up from second place last year to peak on the large city list for 2024, marking the first time since 2013 that Austin has been named the best-performing city. Last year’s top city, Provo, UT, moved down to number five this year. Idaho Falls, ID, topped the small city list for the second year. As denoted in Exhibit 2, Idaho was well represented in the small city list, as four of the top seven small cities were from that state: Idaho Falls (1), Coeur d-Alene (2), Twin Falls (5), and Pocatello (7).

Exhibit 2: Best-Performing Cities 2024 Tier 1 Rankings

Criteria for the rankings contain three components: labor market performance, high-tech impact, and access to economic opportunities. The scores have traditionally focused on labor market performance (using measures of job growth and wage growth for short and mid-term periods) and high-tech impact (by looking at high-tech GDP growth and concentration of high-tech in a region). In 2021, the rankings added broadband access and housing affordability to determine how well metropolitan areas provide economic opportunities for the broader population. Housing cost burden, as reported in the American Community Survey (ACS) one-year estimate, is used as the affordability measure. The source for broadband access is also the ACS. This year, the research team added two more measures to the economic opportunities component: 1) a community resilience metric from the U.S. Census Bureau that determines how well an area can recover from natural disasters and climate changes, and 2) a measure of income inequality (using the Gini Index). The number of inputs to the rankings comes to a total of 13 with these last two additions.

Digging deeper into the components that make up the rankings, a few measures highlight concerns for Arizona cities. The rankings include three indicators of job growth: one-year job growth, five-year job growth, and short-term job growth (the most recent year of monthly data, August 2022-August 2023 for this report). The short-term job growth score dropped dramatically from 2023 to 2024 for Phoenix, Lake Havasu City-Kingman, Sierra Vista-Douglas, and Yuma. On the other hand, Tucson performed better relative to last year for both the one-year and short-term job growth measures. The score for broadband access dropped over the year in every Arizona city except for Sierra Vista-Douglas. It is difficult to determine if the change in score was due to worsening conditions for Arizona metropolitan areas or the result of improvements for other geographies listed in the rankings. The newly added measures of resiliency and income inequality were unfavorable for Arizona cities. Lake Havasu City-Kingman ranked 203, the last spot in the small city list, for income inequality. Income inequality garnered Tucson the lowest score out of the 13 measures composing the rankings (157 out of 200). Yuma scored very low (188 out of 203) on the resilient community measure. Arizona cities performed well on five-year job growth (Phoenix and Yuma), high-tech GDP growth (Flagstaff, Lake Havasu City-Kingman, and Prescott), and the concentration of high-tech industries (Sierra Vista-Douglas and Tucson).

Metropolitan areas measured on the MAP Dashboard performed well in the 2024 Best-Performing Cities list, with one glaring exception – those in Arizona. Tucson and Phoenix both experienced a drop in rank between 2023 and 2024, the only metropolitan areas in the MAP Dashboard to do so. Tucson held the lowest rank out of the 12 metropolitan areas and was also the only MAP area in Tier 4. El Paso and Albuquerque improved the most over the year, moving them from Tier 4 to Tier 3 after scoring lower than Tucson last year. Austin and Salt Lake City scored the highest overall, at 1st and 4th, respectively, earning Tier 1 status, while most MAP Dashboard metropolitan areas were firmly within Tier 2 status, as seen in Exhibit 3.

Exhibit 3: MAP Dashboard Metropolitan Areas

Austin ranked at or near the top in employment growth, wage growth, and high-tech measures, though much lower in housing affordability and income inequality. MAP metropolitan areas tended to do the poorest in housing affordability and resilient communities. Interestingly, Colorado Springs and Salt Lake City attained their highest scores for the resiliency measure. MAP metropolitan areas topped the list with a number one rank for several measures: Austin for five-year job growth and five-year wage growth, El Paso for one-year relative high-tech GDP growth, and Las Vegas for one-year job growth.

Author: Valorie H. Rice is the Senior Business Information Specialist at the Economic and Business Research Center (EBRC) in the University of Arizona’s Eller College of Management.