There are four main parts of your paycheck stub, no matter where you live or what job you have.

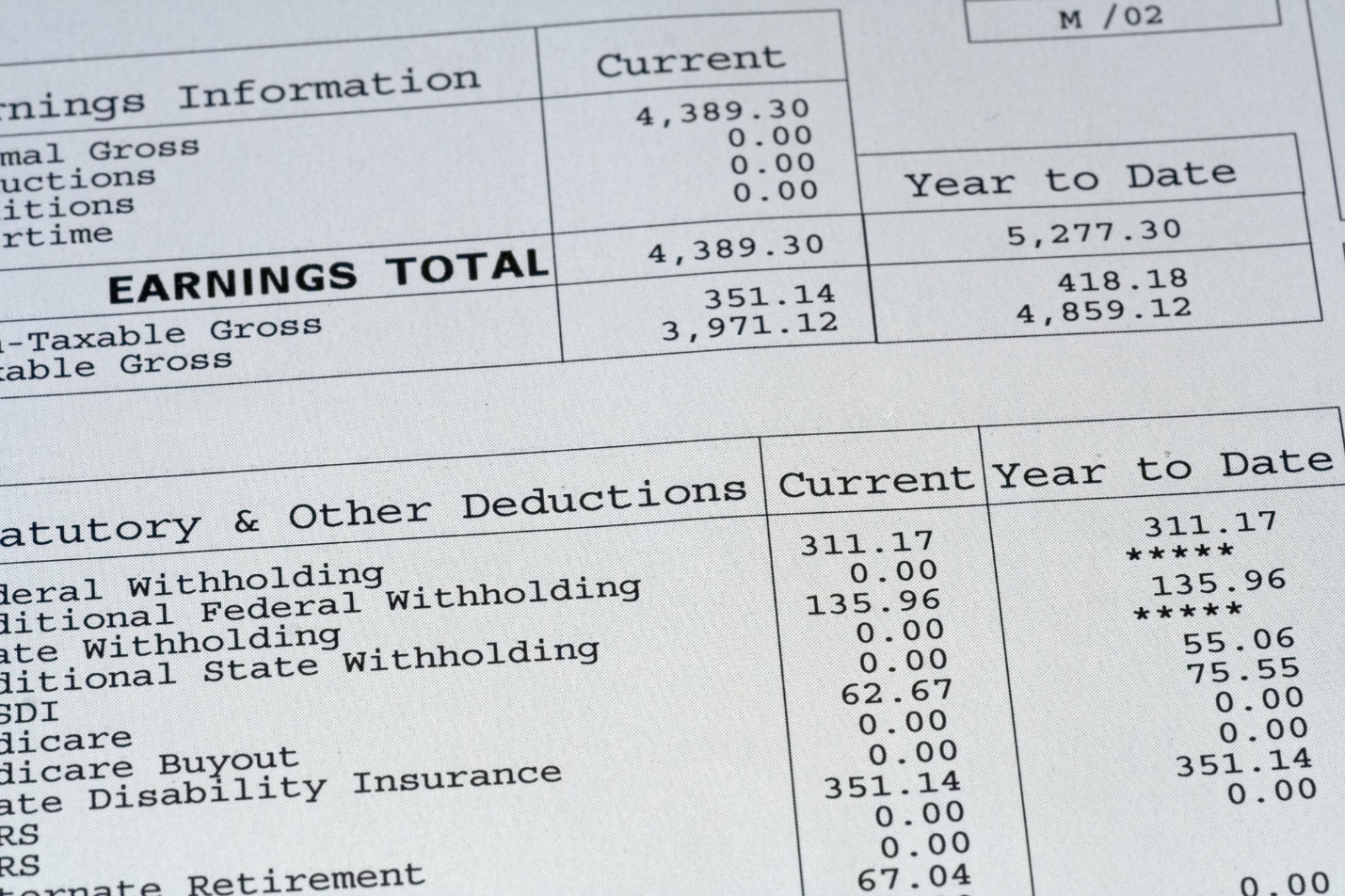

You’ll see your gross pay, taxes, any deductions you or your employers have opted you into, and then your net pay – which is the most important number when it comes to cashing your check in the bank.

Your taxes and deductions are dependent on your state and what benefits your job gives you. Learn more below.

Part 1: Gross Pay

When you get paid, you get a certain rate per hour. Even if you’re salaried, it still breaks down to an equal number of dollars per hour, based on your regular schedule.

Your gross pay is that hourly rate times the number of hours you worked, plus if you worked any overtime or not. It’s a simple hours times rate calculation. This will be the largest number on your paycheck, but unfortunately, it’s not the amount you take home at the end of the day.

Part two, your taxes, are taken as a percentage of your gross or total pay.

Part 2: Taxes

Four main tax items may be taken out, but they differ by state. Florida doesn’t take state income tax out of your paycheck, for example, but most states do. Here’s a quick guide to understand what each category means, where your money is going, and where to find the percentages they take.

Federal Income Tax

The federal government, in all states, takes a percentage of your earnings. The percentage they take depends on how much money you make. The more money you make, the more taxes you pay.

This pays for things like governmental employee salaries, homeland security, federal programs, and more.

State Income Tax

Most states take a percentage of your income as well. This goes to your state programs, like roads and bridges, local health departments, state employees, emergency funds, and more.

Your state income tax also depends on the state and your income.

Social Security

This is the amount that you pay to your future self from your paycheck stubs. It goes into the social security fund, which you can access once you retire. You can think of it as a forced savings account.

Part 3. Other Deductions

This is solely up to you and your employer. When you fill out your employment paperwork, you ask them to deduct a certain amount from your paycheck, if you want. You will also see child care deductions, retirement, or any paid time off here.

The Most Important and Final Part of Your Paycheck Stub: (4) Net Pay

Finally, the number that shows you how much money you’re going to take home is your net pay. That’s the amount of cash you can access after all taxes and deductions are taken out.

If you feel disappointed by the difference between gross and net pay on your paycheck stub, remind yourself that some of those taxes are you paying your future self and paying to be part of a society that gives everyone.