Arizona has a rich history of silver mining. From the early prospectors and the discovery of silver in 1873 to the founding of Tombstone a few short years later. Over time, copper became the main mineral being mined, but there are still deposits of silver in the state.

About 8,600 miles away, there is a huge interest in silver that matches those early days of prospectors hoping to strike it rich. India in 2022, is importing silver in numbers never before matched.

The world’s yearly silver production is somewhere around 24,000 metric tons, but India is not one of the main producing countries. In 2021, India’s silver production realized just 665 kilograms. Therefore, it largely relies on importing this precious metal.

Is India really importing silver bars at historic rates now?

Indian silver investors sold off large amounts during 2020 and 2021 and imports were low. In 2021, just 110 tonnes of silver were imported in the first 7 months of the year. But, that changed at the beginning of 2022.

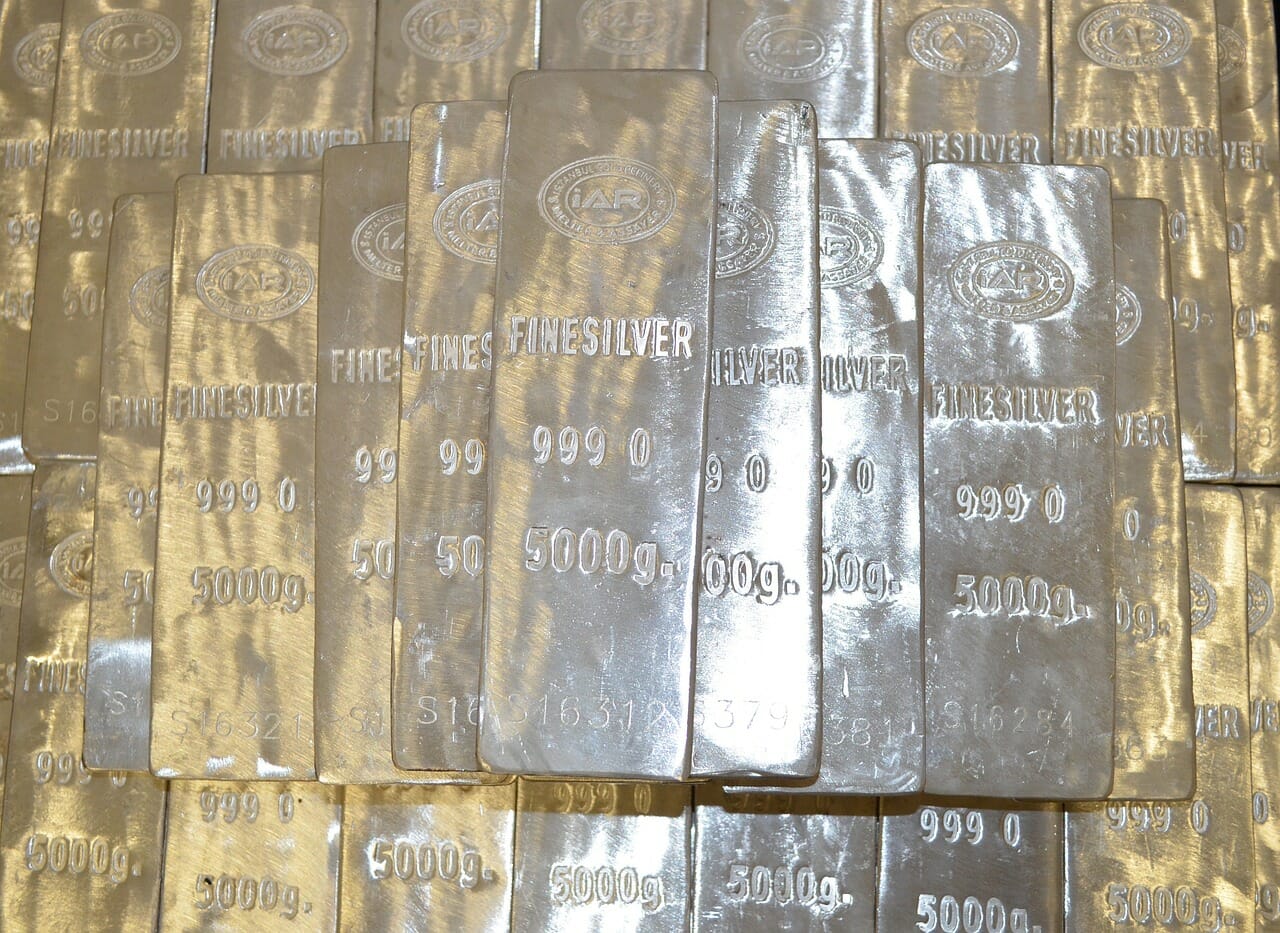

In the first six months of the year, India imported over 5,000 tonnes of silver. Predictions point to 8,200 tonnes of silver arriving in the country by the end of 2022.

Indian investors have a high demand for silver bars in 2022, as they see the precious metal as an excellent investment in the current climate.

Why is India importing silver so much?

Traditionally, the USA accounts for the highest silver imports in the world. In 2020, the US was responsible for importing 22.2% of the world’s silver production.

Now though, India is making waves with sudden increased importing of the precious metal. Indians are finding silver appealing for two purposes; for use in industry, and as an investment.

Many Indian investors believe that silver is underperforming. The value of silver is at a two-year low, and this has led to serious investors importing large amounts of silver. It means that amateurs are keen to learn how to invest in precious metals and join the bandwagon.

What benefits are there in investing in silver now?

Inflation around the world is at record levels in many countries. People are struggling to cope financially on a daily basis. The cost of fuel, food, and basics keeps rising. Even investors are seeing their portfolios lose value across the board. Precious metals, however, are somewhat inflation-resistant.

The inflation rate in India year over year is 6.8%, and inflation brings economic uncertainty. For someone who is looking to invest but is fearful of inflation rates and how stocks may dwindle in value, silver could be a great option.

Traditionally, gold has always been seen as a solid investment, and while silver is something of a lesser cousin, it too can ride out economic storms and recessions.

And of course, if these Indian investors are right, and silver is underperforming, then there could be a sharp rise in value shortly.

Does this imply that you should invest in silver now?

All investments carry a degree of risk. It is very rare that anything is a sure-fire bet, and many a promising IPO has ended in disaster. In 2021, Deliveroo was to be the biggest initial public offering that the London stock exchange had seen in a decade. Yet, almost as soon as trading began, the stocks plunged, wiping $2 billion from the company’s value.

However, if history repeats itself with silver, then there could be many investors in India making a tidy profit soon. At the time of writing, the value of silver was $21.50 per ounce. The highest silver has ever reached was $49.51 in 2011, and it is this kind of level that investors are hoping to see again.

In 2009, and 2011, silver saw huge spikes and the price per ounce rose steeply. The belief that silver is underperforming is what has led Indian investors to empty the world’s silver reserves.

What are the concerns with importing so much silver?

For the investor, there is the obvious risk that the value of silver will drop further, or provide a minimal profit. The hope is that silver will outperform gold, but there is no certainty this will happen.

For the country, there is a problem with the trade deficit. India has a trade deficit of $26.91 billion. With an import bill for silver at a possible $8 billion, this adds more pressure.

Summary

Any investment should be done with care, and research should be made. Ideally, independent investment advice should be taken also. However, it is clear that many, many investors see silver as underperforming. They believe the price has overcorrected itself and has to go the other way sooner rather than later.

While it may not quite match the olden days of gold fever, and prospecting for silver in Arizona, there is clearly something of a frenzy for this precious metal at the moment.