The U.S. inflation rate hit a 40-year high after the pandemic but has since cooled significantly due to factors like the Federal Reserve rate hikes. With the year-over-year inflation rate at 3.1% in January, which is still above the target rate of 2%, the personal-finance website WalletHub today released its report on the Changes in Inflation by City and Phoenix is the city with the 22nd biggest inflation problem.

LEARN MORE: This is why Scottsdale ranks as No. 8 hardest-working U.S. city

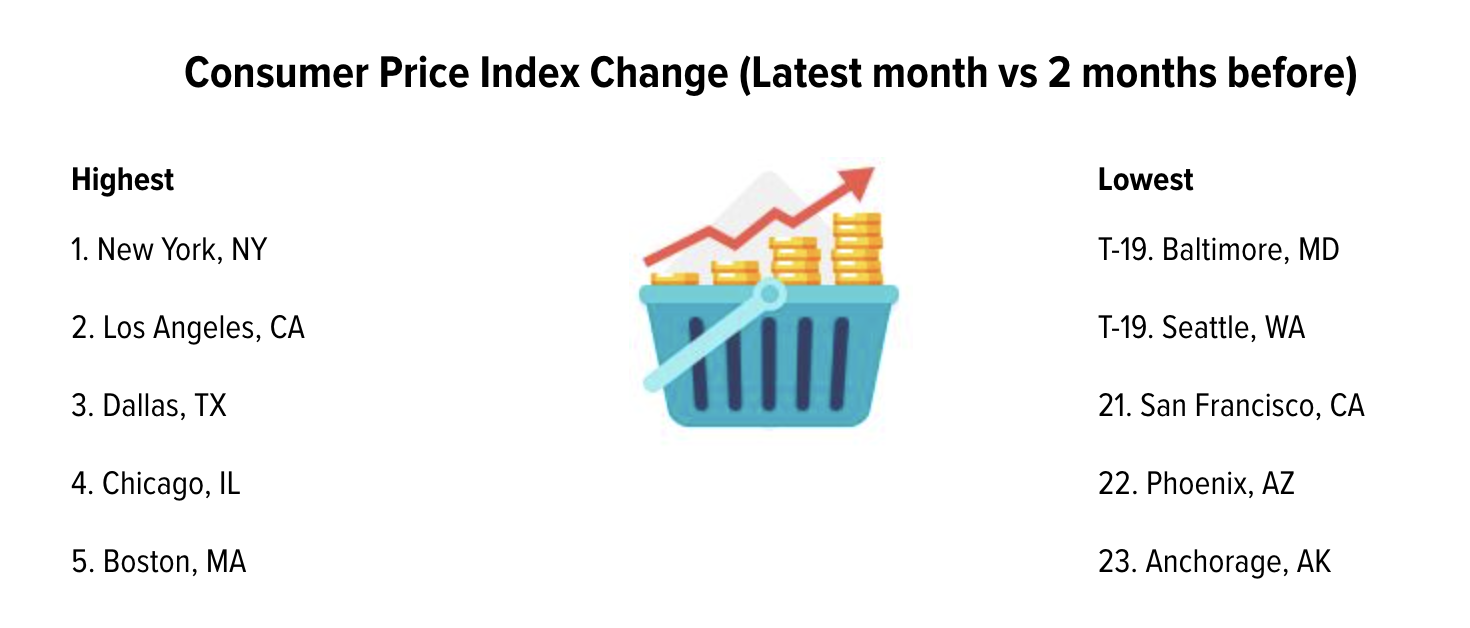

To determine how inflation is impacting people in different cities, WalletHub compared 23 major MSAs (Metropolitan Statistical Areas) across two key metrics involving the Consumer Price Index, which measures inflation. We compared the Consumer Price Index for the latest month for which BLS data is available to two months prior and one year prior to get a snapshot of how inflation has changed in the short and long term.

Various factors, such as the war in Ukraine and labor shortages, drive this higher than average inflation. Despite the country not meeting its target yet, the Federal Reserve is actually expected to cut interest rates this year rather than raising them further.

Inflation rates differ across the U.S., though. To determine how inflation is impacting people in different parts of the country, WalletHub compared 23 major MSAs (Metropolitan Statistical Areas) across two key metrics related to the Consumer Price Index, which measures inflation. We compared the Consumer Price Index for the latest month for which BLS data is available two months prior and one year prior to get a snapshot of how inflation has changed in the short and long term.

Main Findings

Inflation Problem in Phoenix (1=Worst, 12=Avg.):

- Overall rank for Phoenix: 22nd

- 22nd – Consumer Price Index Change (Latest month vs 2 months before)

- 17th – Consumer Price Index Change (Latest month vs 1 year ago)