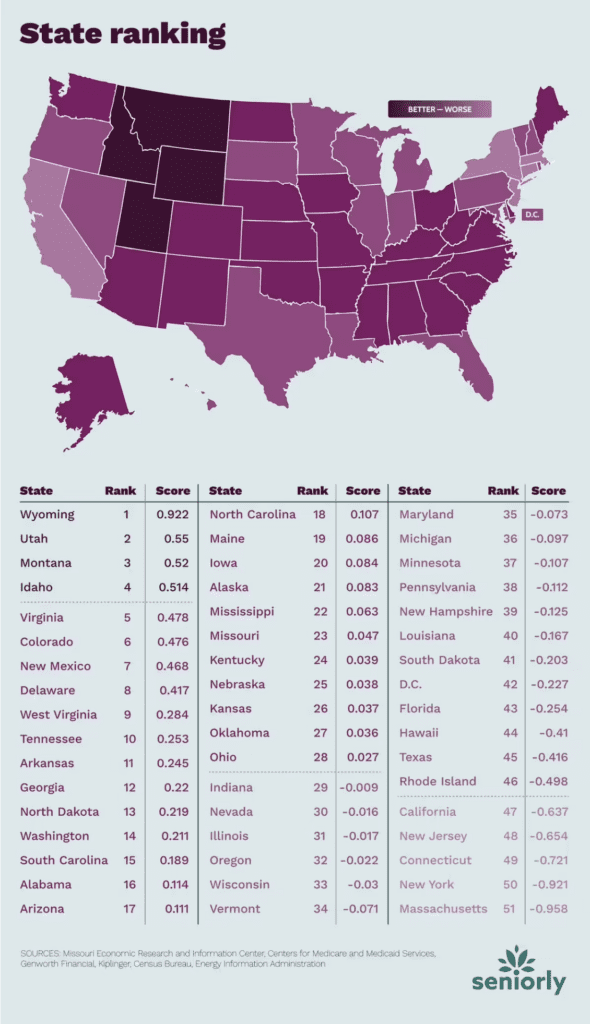

A new studyfinds Arizona is the No. 17 most affordable state to retire amid concerns about inflation cutting into fixed incomes, rising interest rates, banks closures, and Social Security solvency.

DEEPER DIVE: 10 most affordable places to live in Arizona

Americans — worried if they have enough money to live out their golden years — are retiring four years later than they were in 1991 according to a Gallup poll. Where seniors choose to retire will have a major impact on their finances as income, taxes, and expenses vary widely by state.

Seniorly today released a study on the Most Affordable States for Retireesusing the most recent data from the Census Bureau, Centers for Medicare and Medicaid Services, and Missouri Economic Research and Information Center.

Overall, eight financial metrics were analyzed in all 50 states and D.C. including retirement income, tax rates, cost of living, healthcare costs, and senior poverty rates.

Key Findings:

• Arizona: has an average retirement income of $31,468, the average annual Medicare spend is $11,477, and 76.4% of seniors spend less than 30% of their income on housing.

• Five of the 10 Most Affordable States are Mountain states: Wyoming, Utah, Montana, Idaho, Virginia, Colorado, New Mexico, Delaware, West Virginia, and Tennessee.

• Seven of the 10 Most Expensive States are on the East Coast: Massachusetts, New York, Connecticut, New Jersey, California, Rhode Island, Texas, Hawaii, Florida, D.C. The other three are Hawaii, Texas and California.

• Florida: Despite having a great lifestyle for seniors, it ranked as the No. 9 most expensive state due to high Medicare spending, utility bills, and senior poverty rates.

Best and Worst States

Wyoming is the country’s most affordable state for retirees, buoyed by its lower cost of living, Medicare costs and a low senior poverty rate which shows retirees can actually afford to keep living there. In addition, most homeowners spend less than 30% of their income on housing.

Half of the top 10 states – Wyoming, Idaho, Colorado, Delaware and Tennessee – are considered especially tax-friendly for retirees, according to a Kiplinger analysis that takes into account taxes on income, sales, property, gasoline, cigarettes and other factors.

Conversely, the Northeast and West Coast are the least affordable for seniors on a budget, with Massachusetts, New York, Connecticut, New Jersey and California rounding out the bottom five.

That’s largely due to their higher living costs, residential utilities bills and other housing costs. In Connecticut, for example, 1 in 3 older homeowners spend more than 30% of their income on housing.