Today, Charles Schwab released its seventh annual Modern Wealth Survey, an examination of how Americans think about saving, spending, investing, and wealth. This year’s survey shows there is a paradox between how people define wealth for themselves versus how they define it for others. 33% of Phoenix residents who feel wealthy today have an average net worth of $419,000 – compared to the $2.4 million they say it takes to be considered wealthy. It’s clear that for Phoenix residents, non-financial assets like health and family resonate far more when defining wealth than having large sums of money.

DEEPER DIVE: Here’s how much housing affordability has dropped in Arizona

Phoenicians feel slightly optimistic about their personal finances while acknowledging that their location might not help their ability to reach their goals.

These findings are according to Charles Schwab’s seventh annual Modern Wealth Survey, an examination of how

Americans think about saving, spending, investing, and wealth:

• 26% of residents say living in Phoenix “helps” them achieve their financial goals and build their wealth. 28% say living in Phoenix “hurts” their ability to reach their financial goals as the overall “cost of living is too high.”

• One-third (33%) of residents of Phoenix feel wealthy today, and 16%of those who do not currently feel wealthy today believe they are on track to be wealthy in their lifetime.

• 65% of Phoenicians are confident about reaching their financial goals.

HOW PHOENICIANS FEEL ABOUT THE CURRENT LOCAL ECONOMIC ENVIRONMENT:

According to Schwab’s survey, 24% of Phoenicians say the local economy is better compared to the overall U.S. economy, while 58% say it’s about the same and 18% think it’s worse.

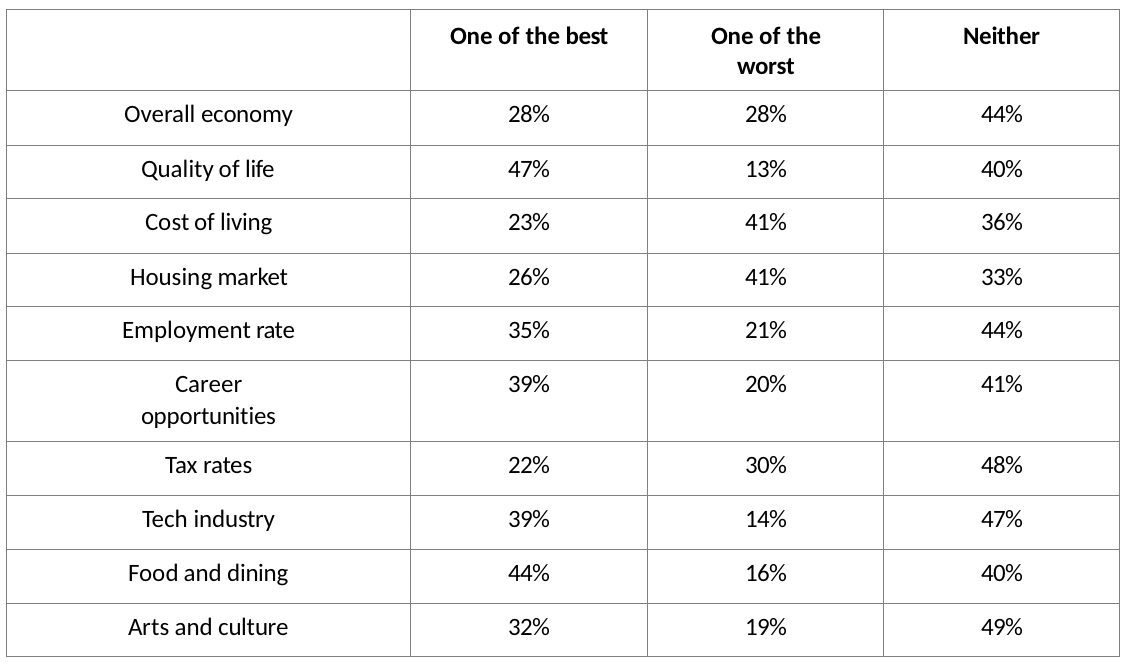

When asked about a range of local economic and cultural factors and how they compare in Phoenix to other cities in the U.S., Phoenicians said the Phoenix area is:

LOCAL IMPACT OF INFLATION“

From food to flights, Phoenicians are feeling the effects of inflation. Nine in 10 (91%) say inflation has affected their finances, which is slightly greater than Americans overall (86%). In addition:

• Inflation is hitting Phoenicians most on things like food and groceries (63%) are spending more than the beginning of 2022), utilities (50% spending more), and transportation (39% spending more).

• Many Phoenicians say they’ve significantly reduced spending on non-essential items (42%) and traveling (39%).

• More than half (61%) have had to reduce the amount of money they’re able to save on a regular basis.

HOW PHOENICIANS DEFINE WEALTH

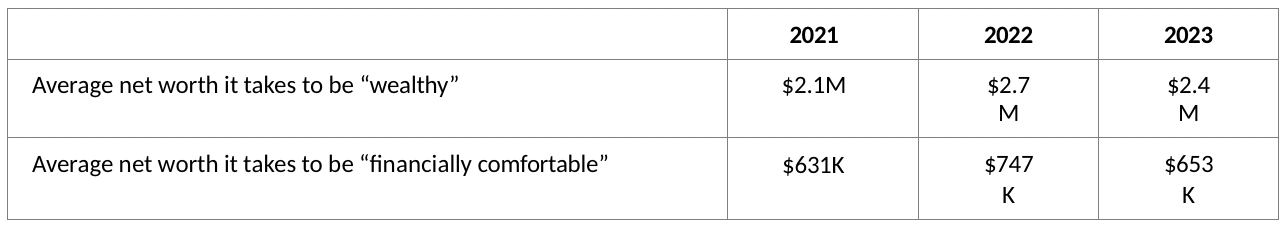

Compared to 2022, Phoenicians redefined how much money it takes to be considered “wealthy,” while the amount it takes to be “financially comfortable” stayed the same:

But there is a paradox, driven by the contrast between how people define wealth for themselves versus how they define it for others. The 33% of Phoenicians who feel wealthy today have an average net worth of $419,000.

However, the amount to be considered “wealthy” in Phoenix is an average net worth of $2.4 million. It’s clear that non-financial assets like health and family resonate far more when defining wealth than having large sums of money, as a significant portion (61%) also reported living paycheck to paycheck.

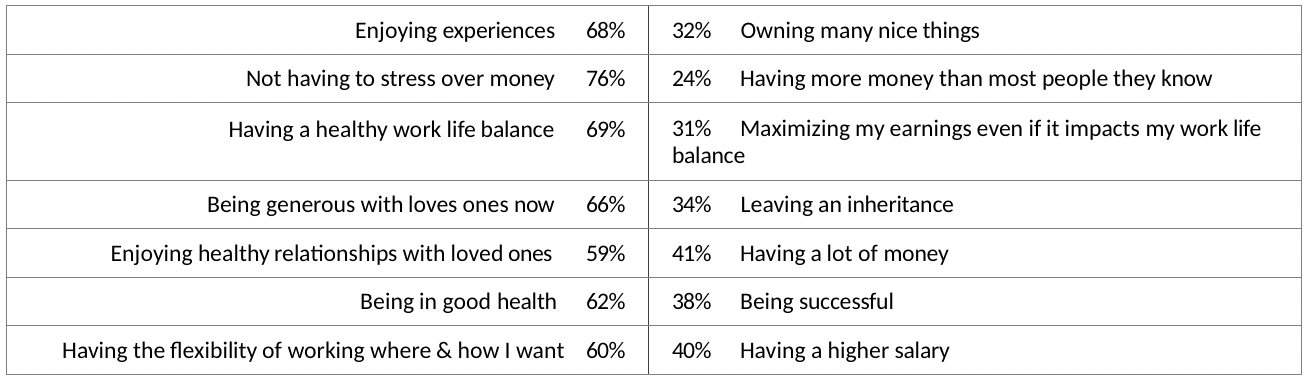

When asked to choose which statement best describes how Phoenicians think of wealth in their own daily lives, the definition of wealth is less about achieving a certain dollar amount. More Phoenicians say wealth means:

Additionally, when Phoenicians are asked to explain what defines being wealthy, ‘having no debt’ tops the list (41%), followed by ‘affording the lifestyle they want’ (36%), ‘having a high income’ (24%), and ‘having good

relationships with family and friends’ (21%).