Demand for industrial & logistics warehousing space is driving an increase in megawarehouses, according to a new CBRE report. Phoenix had four of the largest 100 industrial leases in 2022.

Nationally, there were an unprecedented 63 signings for 1 million sq. ft. or more, up from 57 in 2021. This was a key finding in CBRE’s analysis of the 100 largest industrial & logistics leases completed last year.

DEEPER DIVE: 50 commercial real estate companies to watch in 2023

In 2022, Phoenix had four of the top 100 leases for a total of 4.6 million sq. ft. of industrial space, with two of the leases being traditional retailer/wholesalers. E-commerce had the largest square footage leased in the Valley at 1.2 million sq. ft., and third-party logistics (3PL) secured 1.2 million sq. ft. in Glendale.

“With four leases over 1 million sq. ft. in 2022, Phoenix is evolving into a retailer/wholesaler and distribution-focused market,” said Cooper Fratt, executive vice president at CBRE. “When selecting regional distribution center locations, Phoenix continues to attract occupiers with a robust and affordable labor market and fewer business regulations than other locations across the region.”

Representing over half of the top 100 leases, traditional retailers/wholesalers expanded their footprints to accommodate e-commerce sales growth and to hold more inventory to guard against supply chain disruptions. Third-party logistics (3PL) operators took second place, signing 18 of the top leases, up from 10 in 2021. E-commerce companies followed closely behind with 14 of the top 100, down from 21 in 2021.

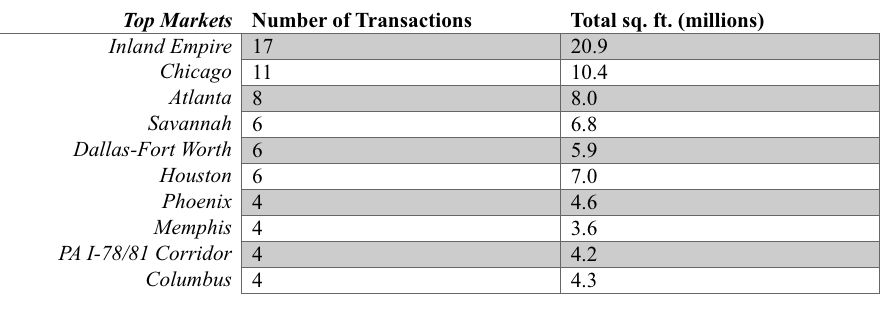

Overall, the average size of the 100 top leases was 1.07 million sq. ft., compared to 2021’s previous record of 1.05 million sq. ft. Top markets for these leases included traditional mainstays like the Inland Empire, Chicago and Atlanta, as well as growing markets such as Dallas-Fort Worth, Phoenix and Columbus.

Top 10 Leading Markets for Top 100 Industrial Leases in 2022

To read the full report, click here.