You spot the perfect warehouse, and the banker says, “You’ll need 25 percent down.” Industry studies show most commercial lenders really ask for 10–35 percent—sometimes less than a home mortgage, according to Benzinga.

With rates sitting at their highest since 2007 and credit still tight, every dollar you keep in your operating account buys breathing room.

So we compared nine financing routes strictly by the cash you must bring to the table. Start with options that require little—or none—of your money, then move toward the classic paths. By the end, you’ll know which lane lets your business keep more working capital.

How We Ranked the Financing Options

We ordered the nine loans by the cash you bring to closing. Less equity lifts an option toward the top; more equity drops it down.

Next, we scored four supporting factors:

- Long-term cost (rate, fees, balloon risk)

- Repayment length

- Speed to close

- Realistic eligibility

A product that keeps payments low for 25 years and funds quickly earns bonus points.

Finally, we tested each loan against common scenarios—owner-occupied space, rural property, and quick-turn purchases—to make sure the lineup matches real-world needs. The result is an apples-to-apples list you can trust.

1. Online Loan Marketplaces

An online loan marketplace lets you submit one application and receive offers from many lenders. The largest platform, Lendio, routes your file to more than 75 funding sources and was named best overall for commercial real estate options by Fit Small Business.

That reach means you can compare an SBA 7(a) quote that needs 10 percent down with a conventional offer asking for 25 percent—before lunch. Competing bids often trim rates and fees you might miss negotiating alone.

Lendio’s commercial real estate portal connects buyers seeking $250 000 to $5 million with a network of 75+ lenders and typically funds deals in 4–8 weeks—you can learn more about the exact terms and documentation before you apply.

Consider a Phoenix manufacturer hunting for a $500 000 warehouse. Within a week she received three offers, chose the SBA route, and kept $75 000 in working capital versus the bank bid. Upload your numbers to Lendio to see how much cash you can keep in the business.

2. SBA 7(a) Loan: Low-Down Workhorse

The SBA 7(a) program finances property, renovations, equipment, and working capital in one package while usually asking for 10 percent down. Some lenders split that equity into a 5 percent seller note and 5 percent buyer cash, so you enter the deal with minimal outlay.

Because the Small Business Administration guarantees up to 85 percent of the balance, banks accept files they would otherwise decline. Terms can stretch to 25 years, keeping monthly payments similar to rent. Most lenders look for a mid-600s FICO score and healthy cash flow rather than perfection.

Rates track the prime index; at today’s prime + 2.5, borrowers see roughly 11–12 percent. While that sounds high, the real gain is owning the building with a fraction of the cash a conventional mortgage demands. For many owner-operators, a 7(a) loan turns leasing costs into long-term equity.

3. SBA 504 Loan: Predictable 10 Percent Down

If the 7(a) loan is a Swiss-Army knife, the 504 is a scalpel built for one job: long-term ownership at the lowest practical cash cost.

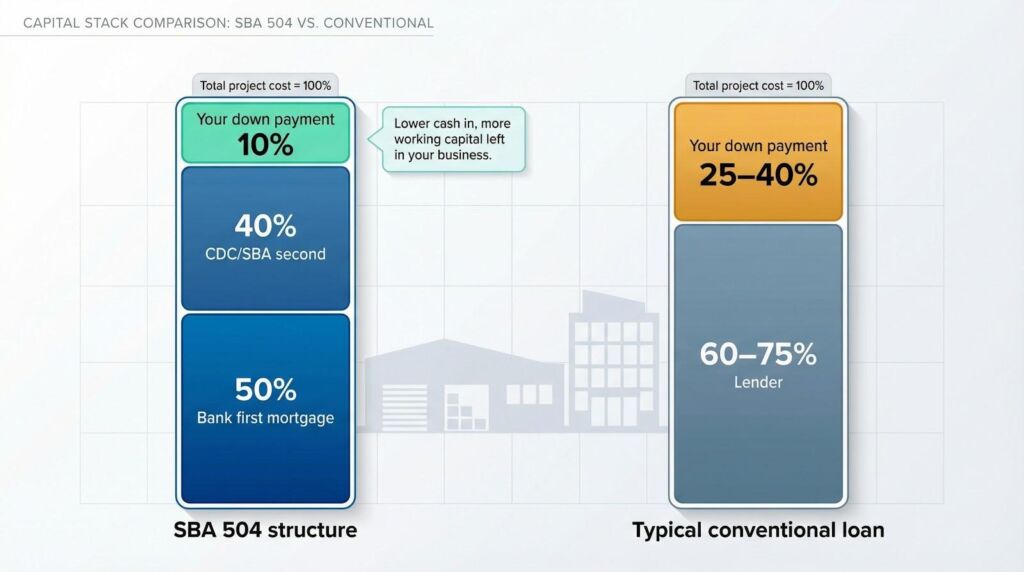

A standard 504 deal splits funding three ways: the bank covers 50 percent, a Certified Development Company backed by the SBA funds 40 percent, and you write a check for the remaining 10 percent, according to TMC Financing. Conventional lenders often ask for 25–40 percent, so this structure can cut your equity requirement in half.

That last slice matters. A Phoenix preschool that bought a $2 000 000 campus with a 504 loan kept $300 000 in working capital instead of locking it in drywall.

The SBA-backed second mortgage carries a fixed, below-market rate for up to 25 years, giving payment certainty on 40 percent of the debt. Blend that with the bank portion and the overall monthly cost often beats local lease rates.

Plan for extra paperwork and a closing window of about 60 days because two lenders must sign off. For owners ready to put down roots with minimal cash, few tools match the 504.

4. USDA Business & Industry Loan: Rural Reach at 80 Percent Financing

If your ideal building sits beyond city limits, the United States Department of Agriculture (USDA) has a Business & Industry (B&I) guarantee many buyers miss. The program lets community banks finance up to 80 percent of a property’s value, so you supply about 20 percent while Washington shares the risk, according to the USDA.

That guarantee often trims interest rates and stretches amortization to 30 years, easing monthly cash flow. The key qualifier is geography: the address must fall in a town with fewer than 50 000 residents, as defined on the USDA rural map. Plenty of Arizona locales qualify, from Camp Verde warehouses to Cochise County storage yards.

USDA Business & Industry loan rural eligibility and 80 percent financing

Because the program prioritizes jobs, highlight how your expansion adds staff or stabilizes local employment. Prove that point and a bank that once demanded 30 percent down may accept the B&I structure instead.

Plan for paperwork similar to an SBA file and two approvals (lender first, USDA second). For businesses anchored in smaller markets, a B&I loan offers a practical path to ownership while keeping more working capital on the shop floor.

FOOD NEWS: 25 places for great patio dining in Arizona

THINGS TO DO: Want more news like this? Get our free newsletter here

5. Conventional Bank Mortgage: The Classic 25 Percent Play

Walk into a mainstream bank for a commercial loan and the first topic is down payment. Most officers open negotiations around 25 percent of the purchase price, reports Swoop Funding. They want real equity, firm debt-service coverage, and a credit file that shows consistent profit.

Why tie up that much cash? Simplicity. One lender, one document stack, and, if your relationship is strong, an approval in about half the time of a government-backed deal. Rates often sit just below SBA floating pricing, especially when you keep deposits or other lines at the same branch. For firms with healthy balance sheets chasing larger properties, the clean path can outweigh the heavier check at closing.

Terms arrive with fine print. Expect a 5-, 7-, or 10-year note amortized over 20 or 25 years, which puts a balloon refinance on your calendar before year ten. Plan early, or the low rate you celebrate today may force an urgent refinance tomorrow.

Bottom line: if you have the cash, want a direct process, and run a proven, profitable company, a conventional mortgage is still a reliable workhorse. Budget for the balloon and the extra appraisal, legal, and environmental fees standard with traditional lenders.

6. Seller Financing: Negotiation Is Your Down Payment

Sometimes the easiest money sits across the closing table. In a seller-financed deal, the current owner acts as the bank and accepts monthly payments instead of a single cash check. Because the terms are personal, you can often agree on 10 percent or even 5 percent down, notes Crexi.

Why would an owner trade a payout for a note? Two reasons lead the list. First, steady interest income helps retirement planning. Second, flexible terms can fetch a higher sale price or move a quirky property that traditional lenders avoid.

Trust drives the conversation. Present solid financials, outline your improvement plan, and offer collateral or a personal guarantee. Many sellers will respond with softer terms such as longer amortization, interest-only periods, or a payment pause during renovations.

Expect some strings. Most seller notes include a 3–5-year balloon, pushing you to refinance after the business proves itself. Missing payments hands the deed back to the former owner, so treat the note with the same discipline you would give a bank.

For buyers low on cash or tired of bank hurdles, seller financing can turn “no deal” into keys in hand. When trust and numbers align, both sides win.

7. Bridge and Hard-Money Loans: Speed Over Savings

When a foreclosed warehouse hits the auction block or a seller says “30 days or no deal,” slow underwriting can kill the bargain. Bridge and hard-money lenders step in for these moments.

These private funds focus on collateral, not credit. Show a solid asset and a clear exit—usually a refinance or resale—and cash can arrive in as little as 2 weeks. Most lenders advance 65–75 percent of the property’s value, leaving you to cover the balance and fees, according to the Forbes Real Estate Council.

Speed has a cost. Rates often sit in the 8–12 percent range, and lenders charge upfront points. Payments are usually interest-only, buying time but not building equity. Terms stay short—6–24 months—so the clock starts the day you close.

Treat a bridge loan like a pit stop. Secure the property, finish repairs, stabilize rents, then replace the loan with cheaper money before the balloon arrives. If you exit on schedule, the extra interest becomes the price you paid for beating slower buyers to the finish line.

8. Equity Partnerships and Crowdfunding: Other People’s Cash, Your Vision

Who says the down payment must come from your wallet? Bring in partners and trade a slice of ownership for the capital you need. A silent investor, a small group of colleagues, or hundreds of crowdfund backers can supply the entire equity stack, turning your personal contribution into sweat, not dollars.

The structure is flexible. Form an LLC that holds the building, then allocate shares based on who brings what. You steer day-to-day decisions; investors collect preferred returns or a share of future appreciation. With no loan on their piece, monthly cash flow improves, easing pressure while your business ramps up.

Crowdfunding platforms like CrowdStreet and RealtyMogul have helped raise more than $200 million for commercial projects, letting owners pitch deals to accredited investors nationwide, according to SEC filings. The platform handles compliance, payments, and reporting so you can focus on the property. In return, expect to give up some control and commit to a clear exit timeline because investors want to know how and when they will cash out.

Yes, sharing upside can pinch when values soar, but the alternative might be watching the opportunity pass. If keeping liquidity matters more than sole ownership, equity partners can turn “too expensive” into “fully funded.”

9. Creative Self-Financing: Tap What You Already Own

Before you seek outside dollars, review your balance sheet. Retirement plans, home equity, unused credit lines, or small-business grants can supply the down payment without calling anyone “lender” or “partner.”

- ROBS rollover: Shift 401(k) or IRA funds into a new C-corp that buys the property. You pay no taxes or penalties, and you keep full control if you follow IRS rules.

- HELOC squeeze: Pull equity from your residence at consumer-level rates, then place that cash into the purchase. Budget for two monthly payments.

- Grants and credits: Some banks and city programs contribute up to $25 000 toward a down payment, especially in opportunity zones or for minority-owned firms. Apply early; funds run out quickly.

- Seller second on standby: Pair a conventional or SBA first mortgage with a no-payment seller note that covers half the equity injection. You put in 5 percent cash, the seller waits quietly, and the senior lender stays satisfied.

Each tactic shifts risk from the deal to you. Retirement dollars lose market diversification, a HELOC pledges your home, and stacking loans raises overall debt. Still, when liquidity is thin but assets are strong, self-financing can bridge the gap and let you secure property while traditional capital catches up.

Quick-Scan Comparison Table

| Financing option | Typical down | Rate style | Term / balloon | Best use case |

| Online marketplace (Lendio) | 0–30 percent | Varies by matched lender | Matches underlying product | Fast quote shopping while exploring |

| SBA 7(a) loan | ~10 percent | Variable (prime + margin) | Up to 25 years | Owner-occupied property plus working capital |

| SBA 504 loan | 10 percent | Blend of fixed + bank rate | 20–25 years, no balloon on CDC slice | Long-term home base with payment certainty |

| USDA B&I loan | 15–20 percent | Fixed or variable | Up to 30 years | Rural projects that create or keep jobs |

| Conventional mortgage | 20–30 percent | Often fixed 5–10 years then resets | 20–25-year amortization with balloon | Cash-strong firms needing a single-bank path |

| Seller financing | 0–15 percent | Negotiable; often fixed | 5–10-year balloon common | Deals where trust replaces bank approval |

| Bridge / hard money | 25–35 percent | High, interest-only | 6–24 months | Time-sensitive or rehab purchases you will refinance |

| Equity partnership / crowdfunding | 0 percent of your money | N/A (investor return) | Exit defined in LLC documents | Growth play when you prefer partners over debt |

| Creative self-financing | 0–10 percent new cash | Depends on source | Depends on source | Tapping retirement, home equity, or grants for the gap |

Conclusion

Use the table as a quick reference; verify current rates and terms with each lender before you commit.

FAQs: Your Top Financing Questions Answered

Can I buy with no money down?

Yes, but only in special cases. A few SBA 7(a) lenders will finance 100 percent for exceptionally strong borrowers, and a motivated seller may accept payments with zero cash at closing. Most buyers should expect to bring 5–10 percent to show commitment.

What credit score do lenders look for?

Traditional banks prefer 700 plus. SBA programs often clear applicants in the mid-600s if cash flow and collateral stand out. Many hard-money lenders ignore scores entirely and focus on property value.

How fast can I close?

Bridge lenders can fund in about 2 weeks. SBA loans average 45–60 days. Bank mortgages usually fall between those timelines, depending on appraisal and environmental reports.

Do I have to occupy the building?

SBA and USDA loans require majority owner occupancy: your business must use at least 51 percent of the space, notes TMC Financing. Conventional, hard-money, and equity structures allow pure investments.

Can I stack options?

Yes. Common pairings include a bridge loan that rolls into an SBA 504 refinance, or a small investor partnership that supplies the down payment on a bank mortgage. Always get your primary lender’s written consent before adding secondary debt.

Are rates expected to drop soon?

Most forecasts call for modest easing over the next 18 months, not a steep fall. Choose financing you can live with today, then refinance if cheaper money appears later.