The fundamental quality of multifamily investing is its ability never to cease earning if a tenant or two wished to cancel their agreements. It will produce enough positive cash flow to self-sustain and add value to the property by several means. A cumulative of such benefits will help expand your portfolio in the future by letting off the current property for a premium added to its market appreciation.

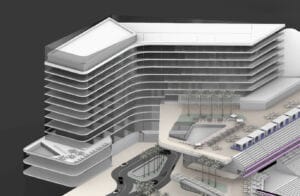

One of the best strategies asset managers opt for while looking for ways to appreciate property value is to re-develop the properties to appeal to potential tenants or buyers. Re-developing properties immediately after purchase is also known as ‘expenditure on the capital of the building’.

Real estate equity experts or fund managers look for details that aren’t openly visible to everyone on the hunt. The important thing here is to see qualities in a property that the competition or the seller never saw, which, if tapped, will return better value. Using these loopholes to your advantage will enable you to ask for a premium in several ways justifiably via increased rent, better demand and tremendous appreciation over time.

The best way to add value by sprucing up the property range is by following the latest trends and demands well-marketed into the customer niche. Finding creative ways to upgrade existing spaces into high-demand homes can save a lot of money on several fronts. Let’s look at some staple options asset managers commonly opt for that are guaranteed to generate higher returns and increase property value while using standard camouflaged cost-cutting tactics.

Value Adding Tricks & techniques

Three key factors are embedded into property development strategies aimed at premium rent and royalty to investors.

Latest trends, traditional add-ons & touch-ups.

Following the latest home trends will mean high-demand finishes and energy-efficient spaces. A few mentions would be stainless steel appliances graded with energy-efficient stars, smart thermostats, better looking LED lighting that’s well-placed suiting the modern-day ambient lighting frenzy. There are both expensive and more efficient ways to achieve these looks.

Real estate private equity firms sometimes dedicate a whole division to research, assess and analyze the best options and techniques to achieve a modern-day, high-performance and aesthetically pleasing home that can attract potential buyers or tenants like moth to a flame.

For instance, the common way to tackle old and scratchy cabinets will be to disassemble them, replace necessary parts and then sand and paint them. Not only is this a permanent solution but a painstakingly long process according to today’s standards. The key here is not just to think cheap but smart cheap. Wrapping cabinets with a protective film instead of sanding and painting will save time, cost less and look amazing. You can wrap it every two or three years to make it look fresh always or maybe change the entire look without much fuss.

Architects and design experts suggest that it is always more economical and easier to add value to a multifamily property with a larger number of units. It helps develop better business relationships with vendors, gets better deals, is good for tax savings and pays for the loan interests.

Talk to an expert

The real estate space operates upon sales tactics and immediate action. While slow growth might seem like a safer option, it is always rewarding when you put in the extra effort to know what could do what and how much it’s worth. Talking to an expert real estate professional or investment manager will help you with a ton of detail-oriented market information that otherwise would take forever for you to grasp.