Meridian Capital Group negotiated a $27 million loan for the acquisition and renovation of Indian Springs Village, a multifamily property located in Mesa, AZ on behalf of a San Diego-based multifamily developer.

The three-year loan, provided by a debt fund, features a floating-rate, interest-only payments for the full-term and two one-year extension options. This transaction was negotiated by Meridian Managing Director, Seth Grossman, and Associates, Sarah Kuebler and Ryan Gandell, who are all based in the Company’s Carlsbad, CA office.

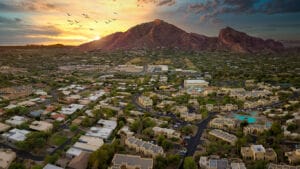

Indian Springs Village, located at 1031 South Stewart Street, totals 460 units. Property amenities include a fitness center, basketball court, outside storage, volleyball court, tennis court, clubhouse, two spas, four swimming pools and laundry facilities.

“The Mesa market has seen tremendous improvement in rental rates and occupancy over the last several years, driven by consistent employment growth and diversity among industries entering the market,” said Mr. Grossman. “Our clients have a strong presence in the Phoenix area and other comparable assets in Mesa. Their vision to reposition this asset with a proven business model and capital budget that was incorporated into the loan proceeds should quickly enhance the asset’s value and continue to improve the immediate submarket,” he added.