Cushman & Wakefield today released its Industrial Construction report, showing demand losing speed as construction completions peak, setting the stage for a return to a more balanced market.

DEEPER DIVE: Phoenix industrial rents increase 31% in 12 months

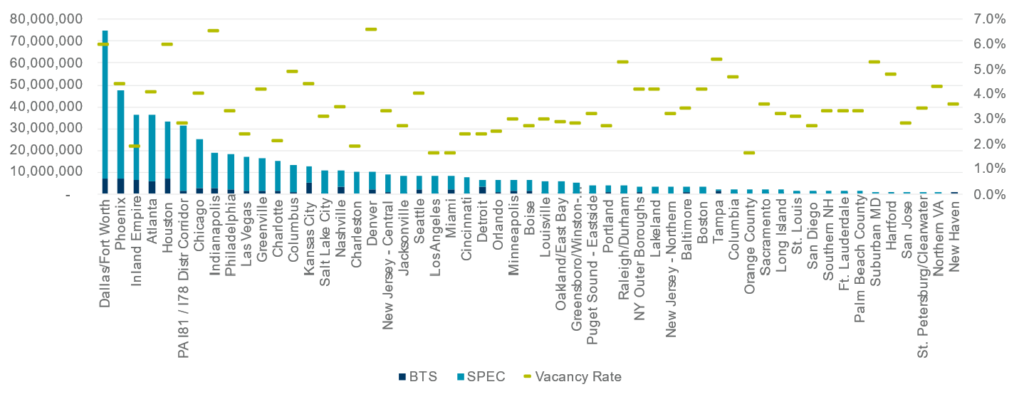

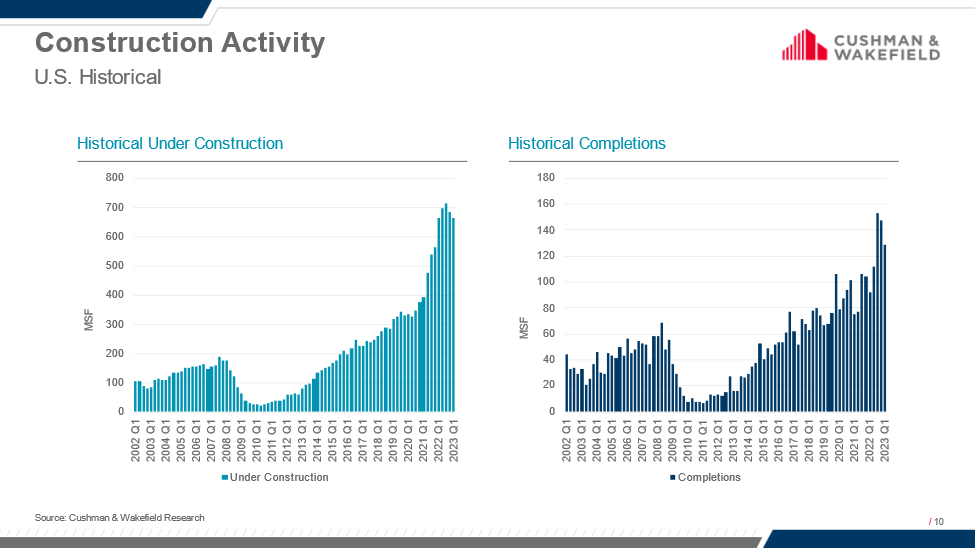

Though Q1 2023 new construction deliveries are up 40% from this time last year with 129.0 million square feet (msf) coming online, starts were down 60% from Q1 2022 levels and fell 34% from Q4 2022. First quarter 2023 starts in the South and West regions, the two regions with largest pipelines, are down 65% and 66%, respectively, from Q1 2022 and all regions lagged at least 32% from the five-year historical start average (2018-2022).

Phoenix industrial construction

• Phoenix has the second largest pipeline next to Dallas/Fort Worth and is considered a larger/growing market with 375 msf of inventory. Phoenix’s growth has accelerated during the pandemic due to population growth/migration and because it is seen as a cheaper alternative to some of the more expensive west coast markets while maintaining proximity to the consumers. While Phoenix has a large speculative ratio, it is sitting at a 4.4% vacancy rate, 360 bps below its 10-year average. It is a market that has registered strong demand in recent years, providing a cushion on the supply risk side.

• From an industrial construction perspective, the West has six submarkets in the top 20, three of which are in the top five. Two of those submarkets, North Goodyear and Phoenix-Mesa Gateway lie in the Phoenix market.

Most developers and owners have started to pull back on launching new projects as demand slows. While the moderating of starts is a positive sign, there is still the threat of oversupply in some markets and submarkets.

“We have started to enter a cyclical reset to the market after two years of unprecedented demand, and the space under construction is nearly four times the size of the pipeline was at year-end 2007. The elevated demand seen throughout the pandemic drove the need to add more space to the market to accommodate occupiers’ growing businesses,” said Carolyn Salzer, Director, Americas Head of Logistics & Industrial Research at Cushman & Wakefield.

“Overall, the pipeline is not as daunting as it may appear by just the headline numbers. Outside of record low vacancies and stable demand, another promising stat to combat the risk of over building is the slowdown of construction starts,” she added.

As demand has pulled back to more historically average levels, the space under development has sustained. The robust pipeline is now sitting at 663.3 msf as of Q1 2023 with 84% of that space being built as speculative space, has brought the conversation to the possibility of overbuilding for the first time in recent memory.

“It is important to note that we are not in the same position we were before the Great Financial Crisis. Right now we’re seeing much tighter market conditions persisting compared to the last expansion cycle. As of the first quarter of 2023, the overall vacancy rate was 3.6% for the nation. Though this was a 40-basis point (bps) bump quarter-over-quarter (QoQ), it still sits well below the 10-year historical average of 5.3% and 430 bps below the 7.9% recorded at Q1 2007,” said Salzer.

On a regional basis, the South posted the highest vacancy rate at just 4.2%, the only region over 3%. This is as expected with the South region making up 48% of the Q1 pipeline and 46% of the deliveries so far this year. The West remains the only region with a sub-3% overall vacancy rate at 2.9%.