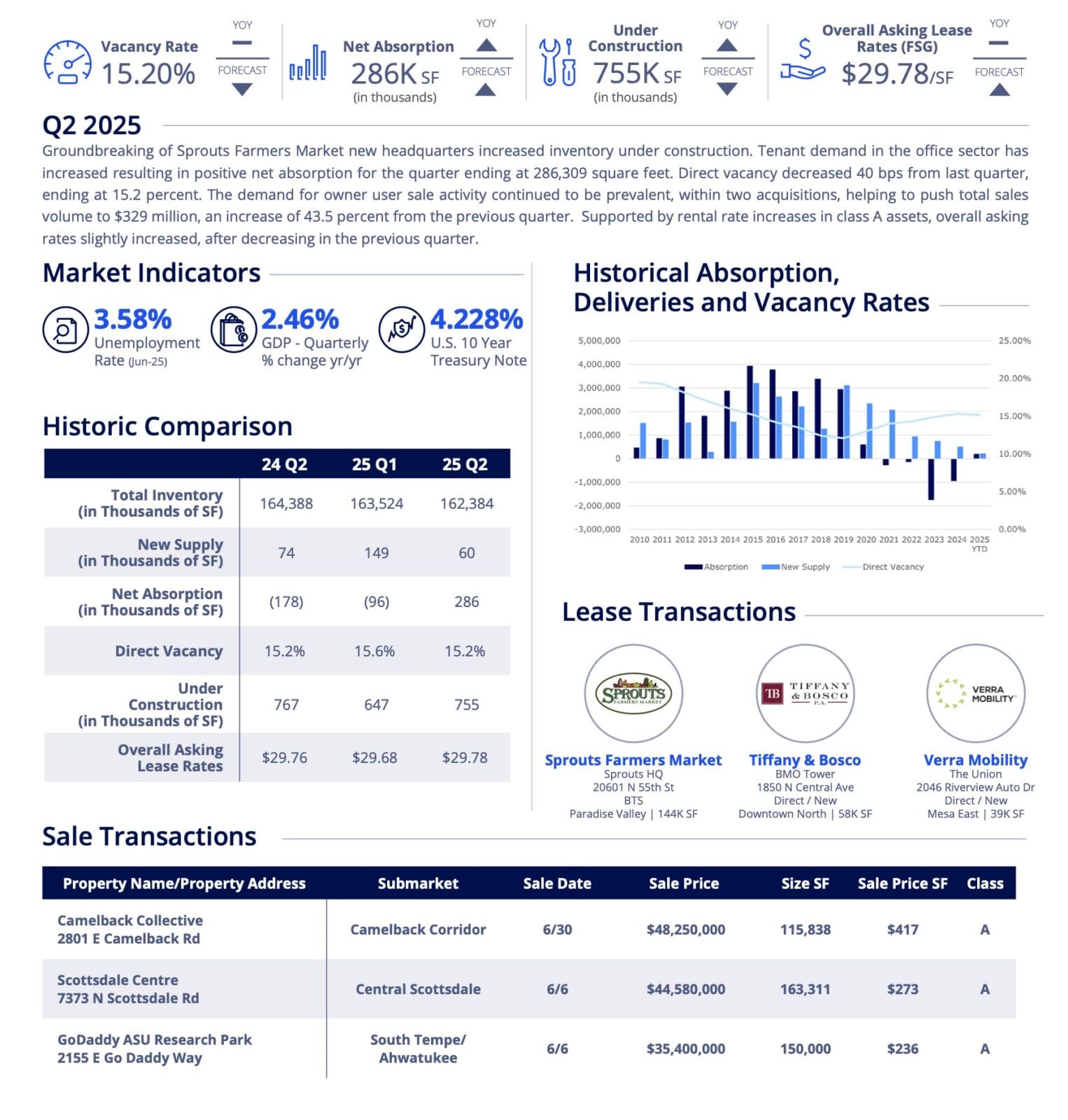

The Greater Phoenix office market experienced a decline in direct vacancy during second quarter, falling 40 basis points to 15.2 percent, according to a report released by Colliers. A trend of converting office properties to industrial usage resulted in removal of nearly 700,000 square feet from the office inventory which contributed to the drop of vacancy.

DEEPER DIVE: Here’s where the residential real estate market stands in 2025

INDUSTRY INSIGHTS: Want more news like this? Get our free newsletter here

Tenant demand has improved in the Phoenix office market, resulting in positive net absorption for second quarter totaling 286,309 square feet. Class A assets lead the market in net absorption year-to-date, illustrating strong tenant demand for best-in-class buildings that offer an array of amenities. Demand from larger user created 14 new direct deals of more than 20,000 square feet, doubling the number of transactions signed in the previous quarter. The largest lease impacting the market for second quarter was the Sprouts Farmers Market headquarters at City North, which is 144,500 square feet of office space, a 25,000-square-foot Sprouts grocery store and 11,000 square feet of additional retail space.

While the direct vacancy rate fell, the market also saw a decline of available sublease space. Strong leasing activity and master lease expirations caused a 20 basis point decline in sublease space from the previous quarter. Total availability declined 60 basis points from firt quarter, resulting in a 19.1 percent overall vacancy rate at mid-year. Class A assets captured the largest vacancy decrease, falling 70 basis poinots quarter-over-quarter to 20.3 percent. However, Class A still holds the highest level of vacancy throughout the market. South Tempe/Ahwatukee submarket experienced the largest decrease in vacancy year-over-year, decreasing 70 basis points to 20.3 percent. This was largely due to Avnet’s owner user purchase of the former GoDaddy building at ASU Research Park. Three office buildings slated for redevelopment to industrial usage were demolished in the market, decreasing inventory by 700,000 square feet. The projects are located in Northwest Phoenix and South Tempe/Ahwatukee submarkets.

Rental rates increases in Class A properties help provide a slight increase to class-wide average rental rates, after decreasing the previous quarter. Average rental rates rose 0.34 percent to $29.78 per square foot. Class A rates rose 1.6 percent year-over-year to $33.99 per square foot. Class B rental rates decreased 2.13 percent compared to the same period a year ago, ending at $26.14 per square foot. Camelback Corridor rental rates set the high water mark for the eighth consecutive quarter, increasing 3.15 percent year-over-year ending at $42.86 per square foot. Currently there are 16 existing office building with asking rates above $50.00 per square foot, located only in Camelback and Tempe submarkets. As rental rates increase in premier assets, tenants facing lease expirations are opting to relocate to less costly submarkets. For instance, a tenant relocating to the Downtown North submarket from Camelback Corridor can benefit from a nearly 90 percent reduction in rental rates.

Sprouts Farmers Market broke ground on its 144,500-square-foot new corporate headquarters, which helped increase the amount of development under construction to 755,662 square feet. New speculative office is a term of the past. However, re-purpose and re-development projects are gaining traction in the market. George Olivers Arbor Old Town redevelopment in Scottsdale began renovations, which will bring a transformation of three buildings spanning 360,000 square feet.

Demand for owner user properties continued to be prevalent, which helped raise the sales volume in 43.5 percent quarter-over-quarter to $329 million. The average price per square foot paid for an office property in second qurter was $214. Year-to-date sales volume has reached $559 million, a slight decline of 3.1 perent compared to the first half of 2024. Central Scottsdale ended the second quarter with the highest sales volume at $49.8 million, driven by the sale of Scottsdale Centre. The Camelback Corridor submarket had the secon d highest level of sales volumen for the quarter ending at $50.6 million across two transactions. Koelbel and Co. acquired Camelback Collective for $48.2 million. Humphreys Capital sold the asset, which it had acquired in 2022 for $66.35 million.

Phoenix remains a popular destination for relocating and expanding businesses. The office market is on the cusp of rebounding, as all metrics indicate the sector moving towards recovery. There are still opportunities around the market for investors, owner user and developers to acquire assets below $100 per square foot, well below replacement costs.