North American data center pricing approached record levels in 2023, with Phoenix boasting some of the highest average asking rates among U.S. data center markets ($170 – $200) for 250-500 kilowatt (kW) per month, according to CBRE’s latest North American Data Center Trend Report.

Leasing activity remains strong, and renewal rates increased by 20% from H2 2022 to H2 2023. The Valley’s vacancy rate is 3.9%, a decrease from H2 2022 and a near-historic low for the market.

Over 88% of the 163.5 megawatts (MW) currently under construction has been preleased, putting additional pressure on developers to find developable land to satisfy the occupier demand in metro Phoenix.

“The demand in Phoenix for data centers is robust,” said Mark Krison, executive vice president at CBRE. “Last year we saw record under construction activity and preleasing levels, which is being driven in part by major hyperscalers who are developing larger campuses to satisfy long-term growth needs.”Phoenix also benefits from its reasonably low power costs, especially when compared to nearby data center markets.

During H2 2022, a major hyperscaler completed a joint venture with Salt River Project (SRP), a non-profit utilities provider. They constructed a massive solar-panel-based power generation plant.

National Trends

In 2023, national average asking prices rose to $163.44 per kW/month from $137.86 per kW/month (18.6% year-over-year increase) and will likely achieve double-digit growth again in 2024. Meanwhile, supply in the eight primary U.S. data center markets* grew by 26%, totaling 5,174.1 megawatts (MW), and vacancy remained near a record low at 3.7%.

“The U.S. data center market saw the largest pricing increase of all commercial real estate assets last year, which is a testament to the market’s resiliency and impact of robust requirements for available power,” said Pat Lynch, executive managing director for CBRE’s Data Centers Solutions. “There is no sign that demand will slow down as the economy becomes more digital and artificial intelligence expands to new sectors. More operators and developers are prioritizing decisions that allow them to provide high value, technologically advanced spaces, which will help to drive future demand.”

Data center construction also reached a new high in H2 2023 with 3,077.8 MW under construction in primary markets, a 46% increase from the same time last year (2,109.2 MW). With AI driving demand across most major markets and project delays persisting, securing space early is crucial. To that end, 83% (2,553.1 MW) of under construction supply is already pre-leased.

While supply chain disruptions have eased, construction costs are rising due to ongoing shortages in critical materials like generators, chillers and transformers. That trend is likely to persist throughout the year. Power constraints are creating opportunities for emerging data center markets in Nevada, Indiana and Wisconsin to host large data center facilities.

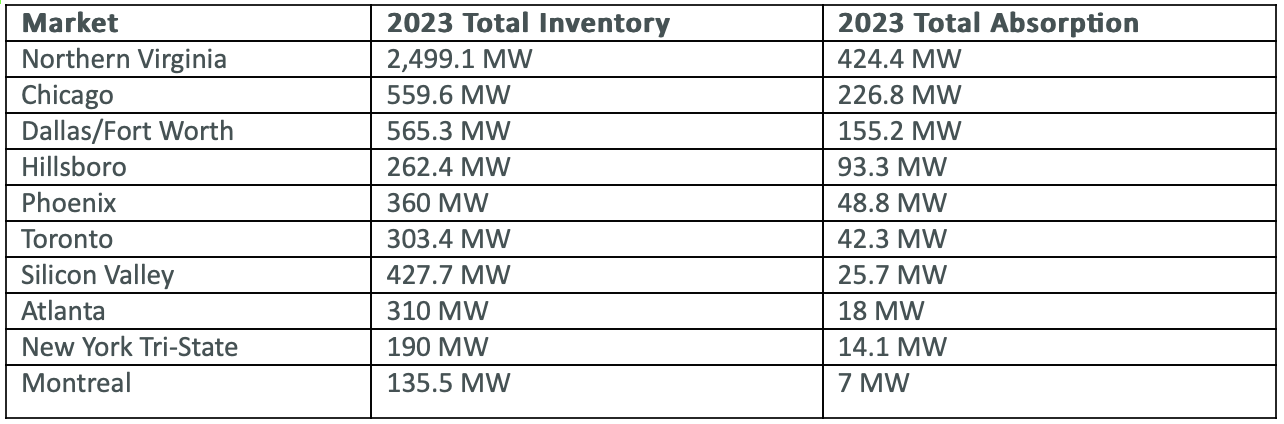

Top Data Center Markets

Northern Virginia remained the most active data center market in H2 2023 with 1,237 MW of construction and 424.4 MW of total absorption for the year.

Top 10 Most Active Markets

Other notable markets include Atlanta, which saw a surge in building with 732.6 MW under construction – a 211% increase since H1 2023 (235.6 MW) and 388% increase from H2 2022 (150 MW). Dallas/Fort Worth reported strong preleasing activity, with 90% of capacity/space under construction (118 MW) already pre-leased.

To view the full report, click here.