So far this year, stabilization has been the word for industrial real estate and industrial markets in the U.S. Considerable reshoring tailwinds are contributing to a surge in manufacturing development. And as more domestic manufacturing facilities near completion in key markets, secondary development from support operations is sure to follow.

MORE NEWS: Phoenix defies trends to lead U.S. in industrial development

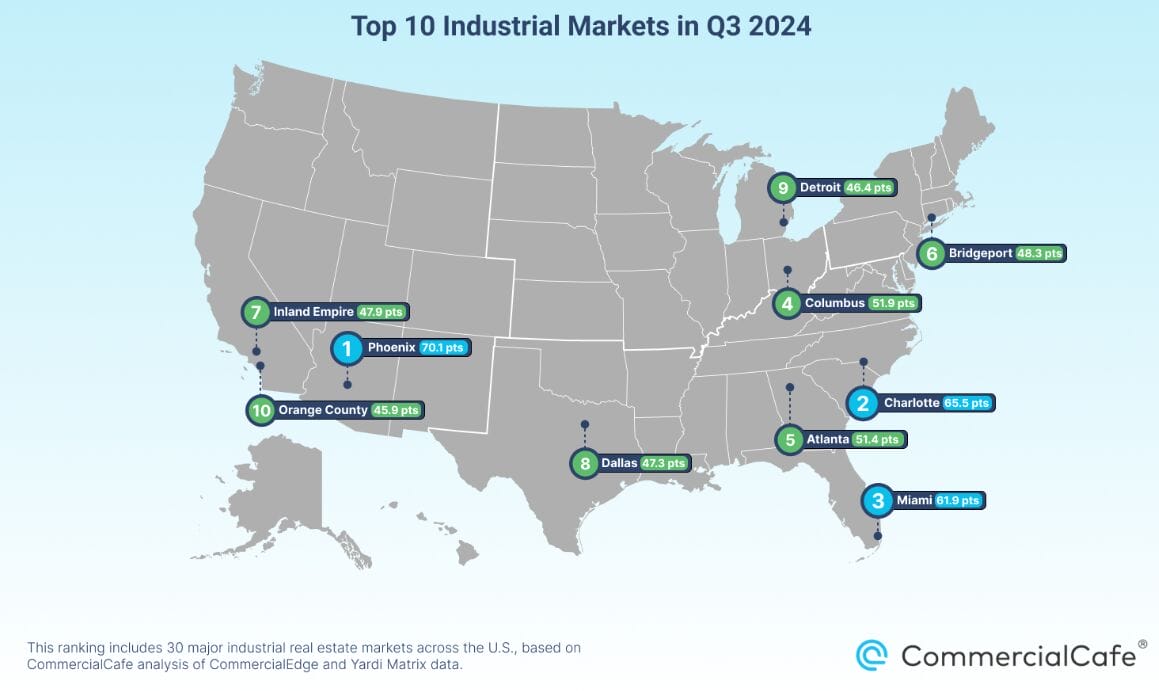

To capture the current trajectory of this sector, we ranked the country’s top industrial markets in Q3 2024 after analyzing them based on key indicators — vacancy rates, development pipelines, rental trends, loan maturities, and search activity — using commercial real estate data and research from CommercialEdge and Yardi Matrix, as well as analysis of Google search trends.

Here are some of the key highlights:

Phoenix boasted 1st place among industrial markets in Q3, totaling 70.1 points out of 100, with most of its points being derived from its accelerated industrial development.

- Phoenix leads the nation in industrial growth, with 32.6 million square feet under development — an 8.7% inventory expansion — being a stand-out amid generally dropping pipelines.

- The 6 million square feet of space delivered in Q3 2024 equivalent to 1.63% of inventory places Phoenix at the top for this metric.

- Phoenix’s average asking rent for industrial space showed the 8th-highest year-over-year increase.

- Meanwhile, industrial vacancy here saw a 0.4% increase (from 5.6% in Q2 2024 to 5.2% in Q3 2024), Phoenix ranking 10th for this metric.

- Phoenix also saw online interest in industrial space growing, with the average monthly search volume for industrial real estate keywords increasing by roughly 19% over 12 months.

You can find more information about this topic in our full study: https://www.commercialcafe.com/blog/national-industrial-report/