Activity from cloud service providers continues to drive data center construction in Phoenix in the first half of 2023, helping the market retain its status as one of the primary data center markets in North America, according to a new report from CBRE.

There is 163.5 MW under construction in H1 2023 and 88.07% percent of the under-construction inventory in Phoenix is already preleased – the third highest among all primary U.S. data center markets. Space in the market is being preleased up to 24 months before it comes online. Nationally, companies are leasing space up to 36 months before construction completion.

DEEPER DIVE: Here’s why data center demand continues to outpace supply in Metro Phoenix

“Ongoing water concerns and requirements from cities to use air-cooled technology has not inhibited data center activity in the first half of the year,” said Mark Krison, CBRE’s executive vice president specializing in data centers. “Metro Phoenix continues to be a prime destination for new data center development with colocation developers and occupiers increasingly competing over the same projects.”

Phoenix experienced a growth in inventory to 360 megawatts (MW) in H1 2023 from 324.5 MW in H1 2022 (11% year-over-year growth). Phoenix also saw rental rates increase 30% year-over-year to $170-$200, the highest increase among all markets, partly due to large hyperscale leasing requirements.

National Trends

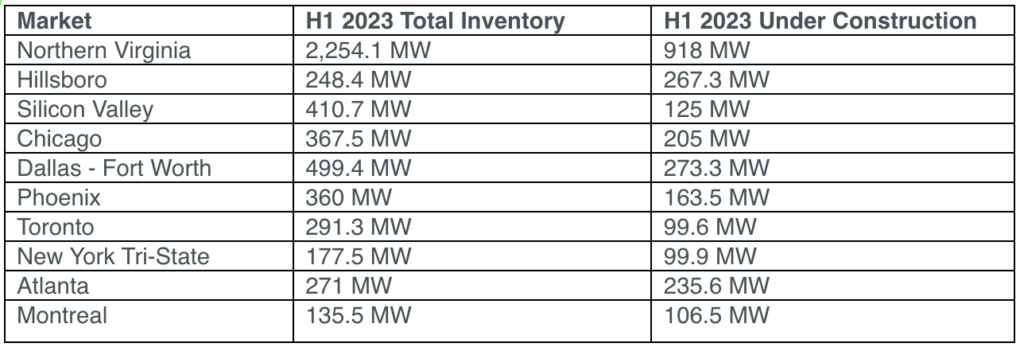

CBRE’s latest North American Data Center Trends Report found there is 2,287.6 megawatts (MW) of data center supply currently under construction, reaching a new all-time high with more than 70% already preleased. At the same time last year, there was 1,830.3 MW under construction. In anticipation of future demand and to secure data center space at current pricing, companies are leasing space up to 36 months in advance of construction completion.

Absorption in the eight primary U.S. data center markets remained resilient in H1 2023, totaling 468.8 MW, despite challenges within the supply chain. While supply increased 19.2% year-over-year, vacancy remains near a record low of 3.3%. Strong demand paired with a lack of available power and extended timelines have kept asking rental rates climbing. Average primary market asking rents rose to $147.80 per kW/month from $127.50 (a 15.9% year-over-year increase).

Top Data Center Markets

Northern Virginia remained the most active data center market in the first half of 2023 with 918 MW under construction. The market set a record low vacancy rate of 0.94% while power improvement projects are underway.

Other market highlights include Dallas -Fort Worth, which saw the greatest year-over-year increase in absorption of 327%, jumping to 110.6 MW from 25.89 MW. Separately, Chicago recorded a 125% spike in under-construction activity – the largest increase among all U.S. data center markets.

To view the full report, click here.