Institutional Property Advisors (IPA), a division of Marcus & Millichap (NYSE: MMI), announced today the sale and financing of Ponderosa Park, a 120-unit apartment property in Flagstaff, Arizona. The asset sold for $28.05 million, or $233,750 per unit.

MORE NEWS: Retail remains red-hot in the post-pandemic recovery

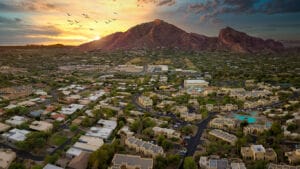

“Ponderosa Park is a boutique, value-add multifamily asset positioned to benefit from the high barriers to development imposed by Northern Arizona’s mountainous terrain,” said Steve Gebing, IPA executive managing director. “Multifamily investors are attracted to Flagstaff due to its diversified economy and favorable supply vs. demand imbalance that contributes to a stable renter base.” Gebing and IPA’s Cliff David and Hamid Panahi represented the seller, Keller Investment Properties, and procured the buyer, Bridge Partners. IPA Capital Markets specialists Brian Eisendrath, Cameron Chalfant, Jesse Zarouk, Jake Vitta, and Tyler Johnson secured acquisition financing. “We are pleased to have successfully closed the acquisition financing for Bridge Partners as they expand their current portfolio into Arizona,” said Johnson. “This closing exemplifies how the agencies are willing to compete for business from strong, repeat sponsors, enabling our team to deliver the ideal solution that matches the client’s investment objectives.”

The property is across the street from Buffalo Park, close to Historic U.S. Route 66 and Interstate 40. Riordan Mansion State Historic Park, Flagstaff Ranch golf club, and Fort Valley Shopping Center are nearby. Major employers in Flagstaff include Northern Arizona University, Flagstaff Medical Center, and W.L. Gore & Associates. Built in 1985 on five acres, Ponderosa Park provides residents with two laundry facilities, a clubhouse, fitness center, and 24-hour emergency maintenance services.