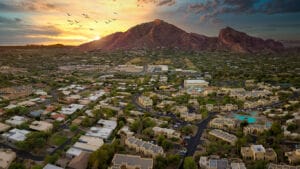

In the past nine days, Rise48 Equity has acquired $73,875,000 worth of new apartment communities in Phoenix, Arizona.

Brookside Apartments is a $41,600,000, 204-unit multifamily apartment property located in South West Phoenix, Arizona.

READ ALSO: Phoenix is No. 1 in U.S. for multifamily construction projects

Rise48 Equity plans to spend over $3,000,000+ renovating the exterior and interiors of the property. They will upgrade the leasing office, add a brand-new fitness center, add a brand-new dog park, upgrade the existing playground with brand new equipment, and upgrade over 45% of unit interiors to the Rise48 Equity Platinum level finish. In addition, Rise48 will rebrand the asset as “Rise Desert West” and install a new monument sign at the property.

City 15 Apartments is a $32,275,000, 161-unit multifamily apartment property located in Central Phoenix, Arizona.

Rise48 Equity plans to spend over $1,000,000+ renovating the exterior and interiors of the property. They will upgrade the pool deck with new resurfacing and brand new pool furniture, renovate the tennis court area by adding a brand new pickle ball court, and upgrade the remaining 30 units to the Rise48 Equity Platinum level. Rise48 will rebrand the asset as “Rise Biltmore” complete with a new monument sign.

Rise48 Equity has completed $289,201,000 in total transactions since 2019, and currently has $249,201,000 of Assets Under Management, all in the Phoenix MSA.

Rise48 Equity CEO Zach Haptonstall said, “We’re grateful and excited to have been able to acquire two new quality assets in the past week. These properties perfectly fit the profile we look for when seeking risk-adjusted opportunities with strong returns for our investors. We’ve already started on the business plan for Rise Biltmore, and we’ll get to work today on Rise Desert West. Thank you to our investors for partnering with us on two new great opportunities.”

Rise48 Equity (http://www.rise48equity.com) is a Phoenix based Multifamily Investment Group. “At Rise48 Equity, we provide opportunities for accredited and non-accredited investors to protect and grow their wealth and achieve passive cash-flow. Our team brings expertise to acquire, reposition and return capital to investors upon reaching our business plan. Through our research and strategically formed partnerships, we acquire commercial multi-family apartment properties, strategically add value to the properties, and create passive income for our investors through cash-flow and profits from sale.”