Trammell Crow Company (TCC), a global real estate developer, and CBRE Investment Management, on behalf of a separate account client, have acquired a 192-acre development site in Mesa, Arizona. The master site will be divided into ‘shovel-ready’ lots that will range from 12 acres, up to the full 192-acre site. These sub-sites will be available for sale to a wide array of interested users; alternatively, TCC will be able to provide build-to-suit solutions for interested corporate users. The sale price was $27,960,939, according to Vizzda.

DEEPER DIVE: Here are the winners of the 2023 RED Awards

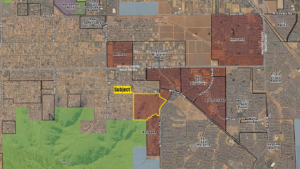

Located in the Southeast Valley submarket, in the center of Mesa’s Advanced Manufacturing Corridor, the site is the largest one in Maricopa County that can accommodate Union Pacific Rail users. TCC will perform horizontal improvements on each sub-site, including the extension of utilities and roadway build out, beginning in summer 2023. The sub-sites, which are located within an Opportunity Zone, are available for purchase or for build-to-suit development.

The master site is located only a quarter mile away from a full diamond intersection along the recently completed SR-24 Freeway Extension, a location that will further stimulate demand from large industrial users who require large, accessible pad sites in an increasingly land-constrained market. Notably, the Union Pacific Pecos Industrial Rail Access and Train Extension (PIRATE) line, planned to be complete by the end of 2023, is set to run directly through the master site; rail accessible sub-sites will be available.

“Despite the uncertainty about the overall economy and the industrial sector in the U.S., the market fundamentals for the Phoenix industrial sector remain strong, with historically low vacancy rates and continued demand for new space carrying through the end of Q4 2022. The Southeast Valley was one of the most active submarkets at the tail end of last year, due in part to the area’s abundant labor pool, and we are still seeing strong activity as we enter the second quarter of 2023,” said Ryan Norris, Principal with TCC.

According to CBRE’s Q4 2022 Phoenix Industrial Market Report, during Q4 2022 alone, 67 tenants were in the market for 8.1 million square feet of space, specifically in the Southeast Valley, where the vacancy rate was three percent. The submarket kept a healthy pace of net absorption and welcomed local and out-of-state business looking for quality industrial space.

Norris continued, “In order to balance the various economic implications – meaning the national economic uncertainty and the continued local demand for industrial space – we wanted to create a flexible development site that allows us to offer sub-divided, shovel-ready sites for purchase, as well as sites where we can implement our build-to-suit expertise for industrial users looking to enter or expand their footprint in the market. Our firm’s ability to anticipate a changing market and implement this type of development concept is an indicator of how TCC remains on its front foot when it comes to delivering the best outcomes for our partners and clients.”

“We’re excited to partner with Trammell Crow to provide this unique, flexible development solution that can serve a variety of industrial users in search of modern industrial space in this key, growing submarket. We believe that the continued high demand for logistics and industrial real estate, the location’s convenient proximity to major transportation nodes and Trammell Crow’s extensive experience in customizing and delivering top-of-the-line properties will offer long-term value for both future occupiers and our client,” said Mary Lang, Head of Americas Direct Logistics Strategies for CBRE Investment Management.

Jackie Orcutt of CBRE and her team represented the land seller, and her team will represent the TCC and CBRE IM JV on the land sale transaction(s).