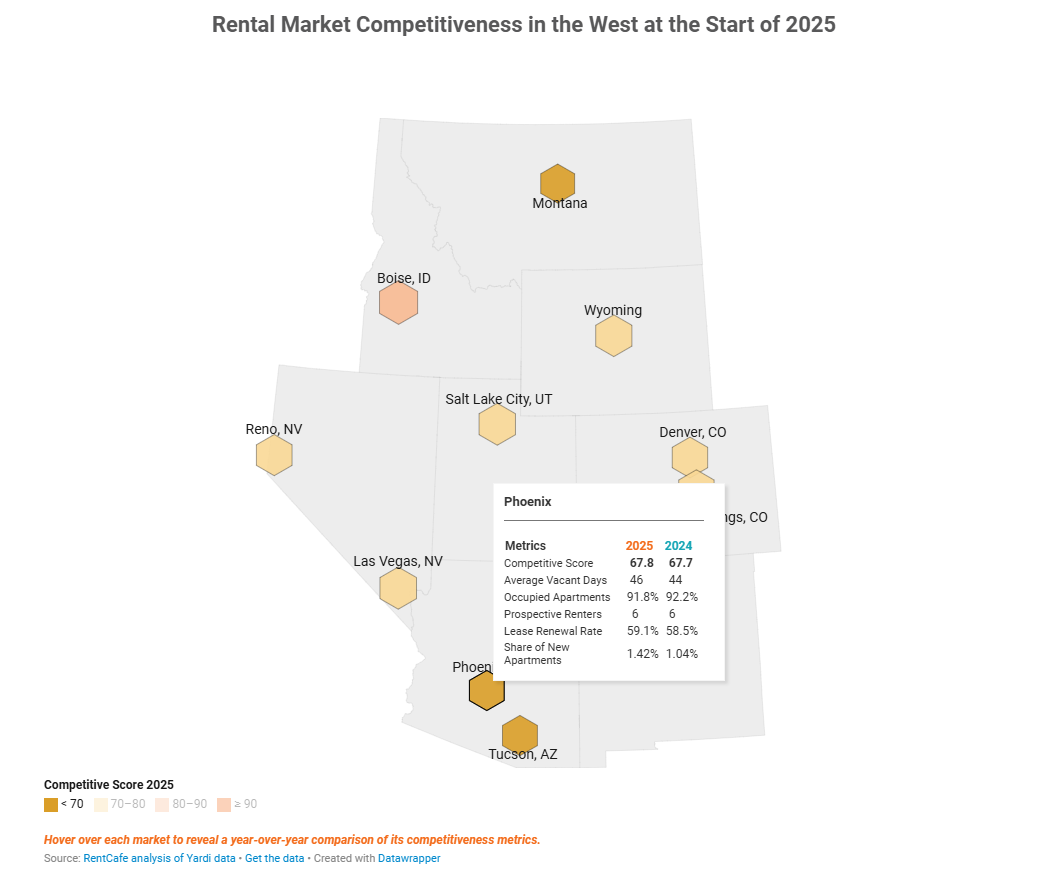

At the start of 2025, the Midwest emerged as the most competitive region for apartment-hunters with 10 metros in the top 20. In particular, Suburban Chicago (ranked second in the U.S.) has positioned itself as a close rival to the number one, Miami, which — despite Florida’s market cooling throughout the past year — continues to lead the nation. Meanwhile, the city of Chicago secures 18th place, further cementing Chicagoland’s strong presence among the country’s hottest rental markets. So how competitive is the Phoenix rental market this spring?

FOOD NEWS: 10 celebrity chef restaurants to try in Arizona

INDUSTRY INSIGHTS: Want more news like this? Get our free newsletter here

So, what are the most competitive rental markets at the start of 2025? To rank the nation’s hottest renting spots, RentCafe.com looked at the 139 largest U.S. markets where data was available. We focused on the five key metrics for rental competitiveness:

- the number of days apartments were vacant

- the percentage of apartments that were occupied by renters

- the number of prospective renters competing for an apartment

- the percentage of renters who renewed their leases

- the share of new apartments completed recently

Key takeaways for the Phoenix rental market ranks:

- New insights: Renters move more frequently in regions with greater apartment availability and more flexible market conditions.

- That said, Phoenix is among the markets with the shortest periods a renter calls an apartment home: 23 months, to be exact. In fact, all Western markets see renters staying less in an apartment than the average U.S. renter (27.8 months).

- Nationally, Colorado Springs, CO, Fayetteville, NC, and Pensacola, FL, are among the markets where renters stay the least in an apartment, averaging 21 months.

- By contrast, markets where renters tend to stay longer also see higher lease renewal rates. This trend is most evident in high-demand, low-supply regions like the Northeast, where renters stay for 51 months, on average.

The Midwest’s appeal to remote workers seeking affordability and more space is also evident in smaller metros. The region claims six spots in the small rental markets ranking, with Lafayette, IN, taking third place.

Challenged by high home prices and overall living costs, many renters are exploring new housing options in early 2025 to better meet their needs. Whether they’re chasing career growth in major urban hubs, seeking a quieter lifestyle in smaller locations, or simply looking for a fresh start in a new neighborhood in their current area, apartment hunters need to plan ahead and weigh their options well before the peak rental season begins.

Key takeaways from the national market:

- The national RCI score of 75.7 signals a highly competitive rental market in early 2025, with more renters staying put compared to the start of 2024.

- Suburban Chicago (now ranking second in the U.S.) challenges Miami, cementing the Midwest’s appeal for renters seeking affordability without sacrificing convenience.

- California’s Inland Empire is the top trending rental market after a 9.5-point jump in its RCI score since early 2024, with the state’s East Bay also growing hotter (up 7.6 points). Manhattan, NY, landed between the two (up 8.2 points).

- With only 3% of units available, Fayetteville, AR — the hottest small rental market — sees vacant apartments fill up in a record 22 days.