While owning a home is priceless, buying one is definitely not. Renters who are interested in trading rent for mortgage to become homeowners seem to be stuck between a rock and a hard place when it comes to budgeting for homebuying.

DEEPER DIVE: Here are the Arizona cities with highest share of $1 million homes for sale

According to a recent study focusing on the cities where renters could get the most and least space if they were to swap their average rent for a mortgage, renters who bought a home and paid a mortgage equal to their current rent would secure less than 1,000 square feet in 63 large U.S. cities.

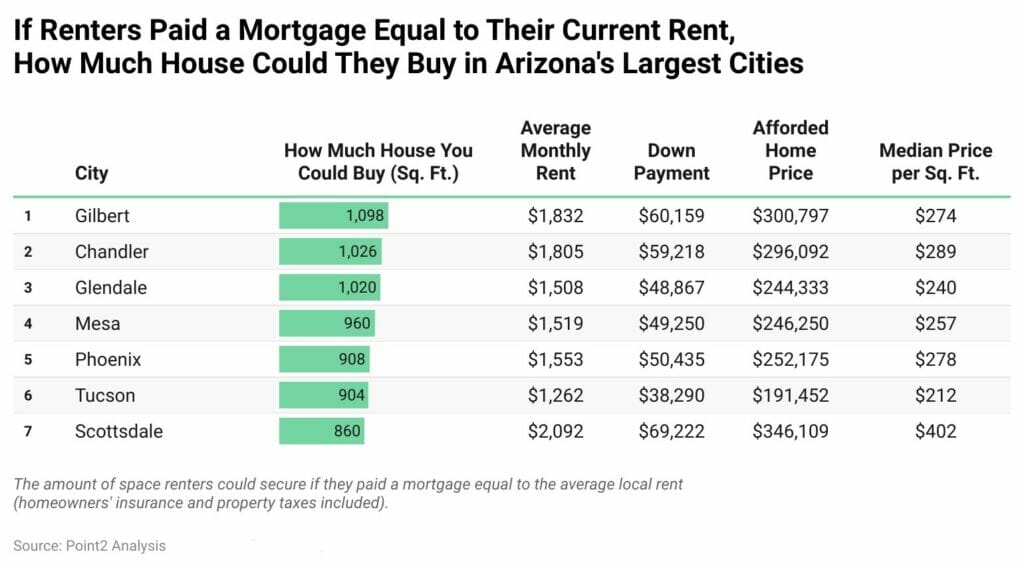

In Arizona, renters face some of the highest average monthly rents in the nation, but also mid-range to high prices per square foot. That’s why aspiring homebuyers who would like to trade their monthly rent for a monthly mortgage of the same amount (complete with property taxes and homeowners’ insurance) would get less than 1,000 square feet of living space in four of the state’s largest cities: Mesa, Phoenix, Tucson and Scottsdale.

Glendale, Chandler and Gilbert are the exceptions: Making the switch to homeownership here could, in theory, secure the most living space.

Here are highlights from the study:

- California dominates this infamous list with 16 of the 63 cities located in the Golden State.

- What’s more, a mortgage equal to their current rent would get potential buyers in Fremont, CA; San Francisco and San Jose, CA less than 600 square feet — the least of all the large cities.

- On the flipside, renters could afford 1,000 to 1,462 square feet in 35 large cities — many of them in Midwestern states like Michigan, Ohio, Indiana and Wisconsin — but also, surprisingly, on the East coast in Pennsylvania, Maryland, Virginia and Florida.

- Only Detroit and Cleveland renters could get more than 2,000 square feet of living space if they became homeowners and replaced their rent with a mortgage of an equal amount.